MortgageRight’s Digital Mortgage App Boosts Profitability

In this article

- A Mobile App for Loan Officers and Borrowers

- Built-in Calculators for Borrowers

- Bilingual Support for a Wider Client Base

- Complete Loan Application on Any Device

- Automated Loan Status Updates

- Mobile eSign Convenience

- Seamless Integration with Loan Origination Systems (LOS)

- Conclusion: A Game Changer for Modern Mortgage Lending

In today’s digital world, the mortgage industry is moving fast to meet the demand for speed, efficiency and a seamless customer experience. One of the most powerful tools in this revolution is MortgageRight’s digital mortgage app powered by nCino’s Mortgage Suite. Formerly SimpleNexus, nCino’s mortgage technology is designed to increase profitability by automating the loan process and delivering an amazing experience for mortgage professionals and their borrowers.

nCino’s digital mortgage software is a game changer, with a ton of features that not only streamline the lending process but also boost loan officer productivity. Let’s dive into how MortgageRight’s use of nCino’s Mortgage Suite can increase profitability, borrower satisfaction and simplify the mortgage experience for everyone involved.

A Mobile App for Loan Officers and Borrowers

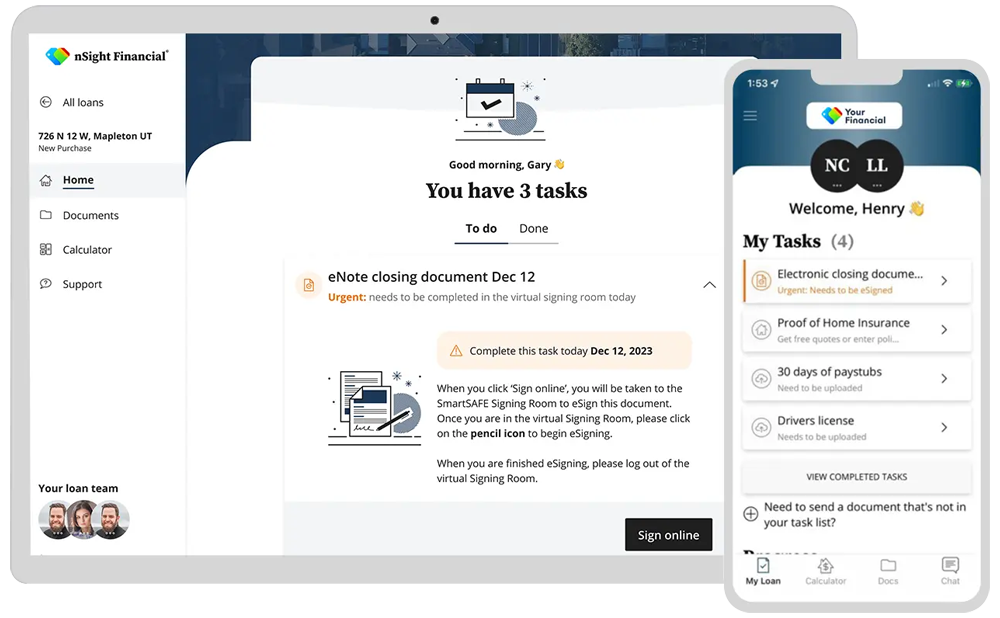

The heart of MortgageRight’s digital mortgage app is its mobile interface, where loan officers and borrowers can complete tasks from anywhere, at any time. Loan officers can manage their pipeline, communicate with clients and track applications all from the palm of their hand. Borrowers can submit documents, track their loan status and even eSign documents – all from their mobile device.

This mobility is key in today’s world where time is of the essence and being able to work on the go can make all the difference in closing loans faster and borrower satisfaction.

Built-in Calculators for Borrowers

nCino’s Mortgage Suite has built-in calculators that allow borrowers to run loan options directly in the app. These tools let borrowers estimate monthly payments, determine affordability and explore different loan types and terms. Being able to run these calculations on their own terms gives the borrower more control and insight without having to ask a loan officer for basic information.

For loan officers, this means borrowers are better informed before they even start the application process, resulting in higher quality leads and fewer roadblocks during loan origination.

Bilingual Support for a Wider Client Base

In a more diverse market, bilingual support is a major advantage. nCino’s software has bilingual support, so MortgageRight can serve a broader client base by supporting English and Spanish speaking borrowers. This means breaking down language barriers and making it easier for borrowers to engage with the loan process and feel confident in their choices. For loan officers this is a powerful tool that expands their client base and allows them to serve a diverse demographic and increase loan volume and profitability.

Complete Loan Application on Any Device

Borrowers no longer need to be tied to a desktop computer to complete a loan application. With nCino’s digital mortgage app, borrowers can complete their entire loan application from any device – smartphone, tablet or laptop. This flexibility means borrowers can apply at their convenience and increase the chances of them completing the process on time.

For loan officers this streamlines the application process by eliminating in-person meetings and lengthy back and forth communication. It also minimizes the chance of borrowers abandoning the application due to technical issues or inconvenience.

Automated Loan Status Updates

One of the most frustrating parts of the mortgage process for borrowers is the lack of transparency around their loan status. nCino solves this by automating loan status updates. Borrowers are automatically notified at key stages of the loan process – from document submission to underwriting approval and beyond. These automated updates reduce borrower anxiety and create a more transparent and positive experience overall.

For loan officers these automated updates reduce the need for constant follow ups and allow them to focus on other parts of their work. They also increase client satisfaction as borrowers feel more informed and engaged throughout the loan process.

Mobile eSign Convenience

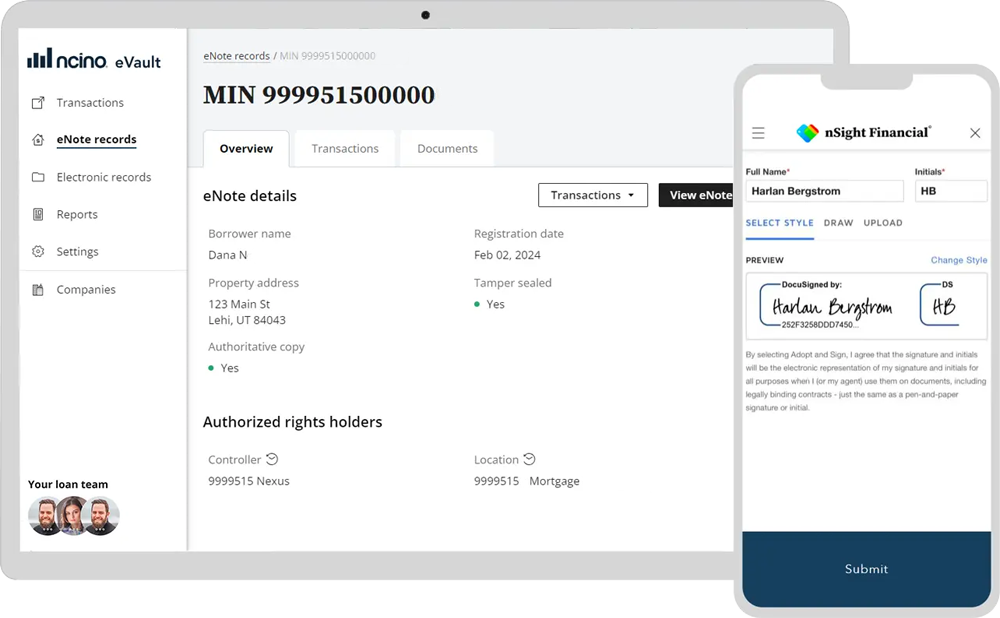

Digital signing of documents is no longer a nice to have – it’s a must have in today’s digital mortgage world. nCino’s suite includes a mobile eSignature feature where borrowers can review and sign documents from their phones or tablets. This allows borrowers to submit documents and review and sign documents and documents from their phone or tablet. Working with all types of loans from one platform means the loan officer’s workflow is more efficient as they don’t have to switch between multiple systems to manage different loan types. For borrowers this means a seamless experience where they can apply for and manage any loan type with ease.

Seamless Integration with Loan Origination Systems (LOS)

One of the key features of nCino’s Mortgage Suite is seamless integration with Loan Origination Systems (LOS). By connecting to the existing LOS infrastructure, nCino’s software allows for real-time data exchange and ensures the loan process is in sync across all platforms. This eliminates manual data entry, reduces errors and accelerates the time it takes to move loans through the pipeline.

For loan officers this means less time spent on administrative tasks and more time spent on high value activities like client engagement and loan origination. For borrowers it means a smooth error free experience from start to finish.

Conclusion: A Game Changer for Modern Mortgage Lending

nCino’s Mortgage Suite, now part of MortgageRight’s digital mortgage app, is a powerful tool that changes how mortgage professionals work. By automating the loan process, improving the borrower experience and offering a suite of features to increase productivity nCino’s software helps loan officers close more loans in less time and at greater profit.

With features like mobile access, bilingual support, automated updates and seamless LOS integration MortgageRight’s digital mortgage app powered by nCino is a must have tool for any mortgage professional looking to stay competitive in today’s fast paced market. For borrowers it means a smoother more convenient experience from application to closing.

Ready to take your mortgage business to the next level? Embracing this technology is the first step to more efficiency, higher profits and better customer satisfaction.